By Marisa L. Zansler

Two decades of decline has resulted in a loss of nearly 2 out of every 3 acres since 2004.

That is a sobering statistic, and it captures the harsh reality of Florida’s iconic citrus industry. The symbol of the state’s agricultural strength has endured a prolonged period of decline driven by the impacts from the spread of citrus greening, devastating hurricanes and years of economic strain on growers.

In just over 20 years, Florida has lost close to two-thirds of its citrus acreage. Every lost acre represents more than trees and production. It represents family legacies in peril, juicing facilities and packinghouses that once bustled with activity that now contemplate alternative products, and stolen economic contributions to the communities built around this crop.

Yet, even amid this stark reality, the industry is now at an inflection point. With new funding committed to replanting and recovery, Florida citrus can reverse its current trajectory.

FLORIDA’S CITRUS DECLINE IN FOCUS

The loss of more than 470,000 citrus acres since 2004 isn’t just a statistic, it stands as a powerful reminder of how deep this crisis runs. Florida’s citrus footprint has shrunk from over 748,555 acres when greening was first detected in 2004 to fewer than 275,000 acres in 2024. This has rippled through the industry’s infrastructure, weakening its supply chains, and diminishing the state’s role in the global orange juice market.

Between 2023 and 2024, Florida citrus acreage has dropped substantially, falling to 274,705 acres, down 17% in a single year. All citrus varieties are affected, reflecting the persistent pressures from HLB disease, hurricanes and increasing urbanization.

The implications have been severe. Along with reduced acreage and production came higher costs of production, higher costs for processors and packinghouses, and record-high prices for consumers. The declining crop has also opened the door for foreign suppliers, especially Brazil and Mexico, to fill the gap, putting Florida’s long-term share of the market at risk. Beyond the farm gate, the loss reverberates through rural communities where citrus is more than an industry; it’s a major economic contributor of entire towns.

INVESTMENT IN RECOVERY

While the past two decades tell a story of contraction, the next two decades must tell a story of renewal. Recognizing the urgency, the state of Florida has increased support with the most aggressive replanting strategy in decades. With nearly $140 million committed, including $104.5 million for basic research, field trials and replanting efforts through the Citrus Research and Field Trial programs and the Citrus Research and Development Foundation, the plan represents both a lifeline and a blueprint for recovery.

One sign of innovation on the ground is the planting of new citrus varieties bred to better withstand, and in some cases resist, citrus greening. Approved by the Florida Citrus Commission as recently as October 2024, these promising trees are already moving from research plots to groves, with commercial plantings beginning this summer through the Program for Expedited Propagation.

The replanting investment, coupled with new innovations, is estimated to stimulate 4.5 million new orange trees planted across roughly 25,625 acres over the next three years. State funds are expected to cover an average of $4,176 per acre to ease the steep upfront costs.

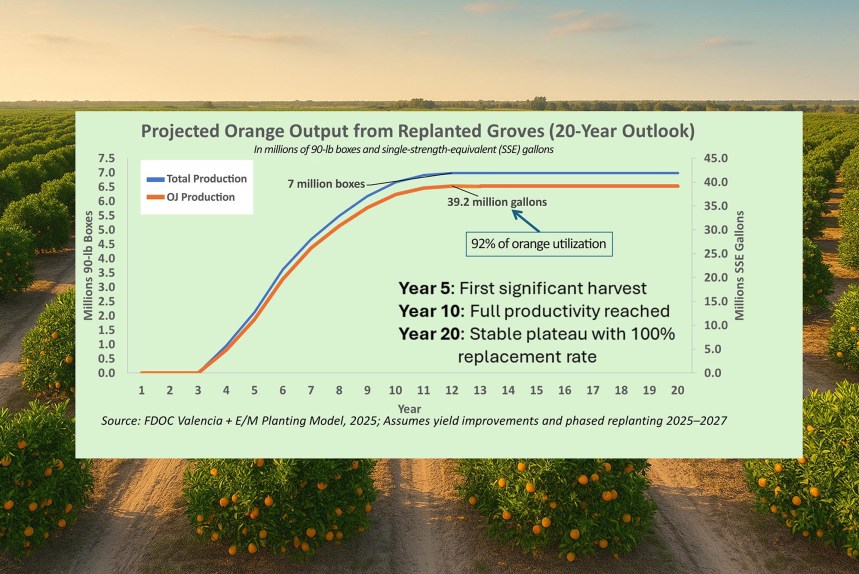

This is more than just a state‑funded effort. Florida growers are matching the commitment with considerable investments of their own funds, land, capital and their trust that Florida citrus has a future. Together, these efforts are expected to bring meaningful fruit production within five years, reach full productivity in 10 years, and eventually yield more than 7 million additional boxes of fruit annually. Over two decades, the new plantings could generate an additional 7.7 million boxes a year on average and $225 million in net grower income.

Notably, these projections reflect a conservative estimate, as they focus primarily on orange plantings and do not yet account for the potential contribution of grapefruit and specialty varieties. This is not a small-scale effort, but a bold commitment between the state and growers to change the trajectory of Florida citrus.

FROM DEFENSIVE TO OFFENSIVE

For years, Florida citrus has been on the defensive, protecting groves, battling greening and implementing new strategies — all while trying to slow the rate of loss. Collective replanting is an offensive strategy. It signals that the industry is not simply accepting decline but actively working to reverse it. The time is now, and the momentum will require more than state dollars.

As growers step forward, willing to take on caretaking costs and the long wait for new trees to bear fruit, processors and packinghouses must plan for how to absorb and promote future production. Given the economic contributions of the industry, policymakers are committed and know that rebuilding a more than 200-year-old industry takes time and patience.

The loss of 2 out of every 3 acres is the industry’s defining challenge. But it also gives the industry defining opportunities: to replant smarter, to keep citrus lands in production and to align production with future market demand. With growers, the state and the industry aligned, Florida citrus has a real chance to reclaim its future.

Marisa L. Zansler is the director of the Economic and Market Research Department of the Florida Department of Citrus in Bartow.

Share this Post